数字化ABCs | STA行业分析:数字资产的可行托管方式

摘要:如今,数字化资产的托管与投资方式已经发生了翻天覆地的变化。

Everything changes when it comes to how we custody assets and investments that are represented digitally

如今,数字化资产的托管与投资方式已经发生了翻天覆地的变化。

随着数字证券的诞生,投资私人证券拥有了完全数字化的新体验。以前投资私人公司时,您的所有者权益很有可能仅会体现在法律文书和由该公司管理的资本化表单之中。

Attempting to sell or transfer your ownership would be a governance procedure that involved lawyers and management. The analog task typically costs time and money. Tools like Carta can help address this pain point, but the available options do not offer a comprehensive solution for the entire process, especially outside of the venture asset class. Secondary markets for any of these asset classes have been exceptionally rare, so the need for custodians was never apparent. Now that we are developing new and innovative solutions for asset-holders in these industries, it is clear that a more complete solution is needed.

试图出售或转让您的所有权将是事涉律师和管理层的受监管过程。模拟任务通常需要耗费时间和金钱。而像Carta一类的工具就可以帮助解决这一痛点,但其可用功能却并不能为整个过程提供全方位的解决方案(尤其是非风险资产类别的操作)。这些资产类别的二级市场极为罕见,因此对托管人的需求从未明确。既然我们正在致力于为这些行业的资产持有人开发新的创新解决方案,那么显然就需要设计出一个更加完整的解决方案。

Now enter the era of security tokens, where investors receive a legally-binding, digital representation of the ownership in the asset they just purchased. The technology enables easy transfer of ownership with minimal impact on the management as records are automatically updated by smart contracts. From a technical perspective, the digital wallet that holds your Security Tokens is your custody solution. An argument could even be made that whoever owns the wallet is responsible for its custody in cases where you transfer your Security Tokens to an exchange or asset manager.

在数字资产新纪元中,投资者在购进资产后即刻便可获得具有法律约束力的数字化资产所有权证。由于智能合约会自动更新记录,因此该技术可以在将对管理的影响最小化的前提下轻松地实现所有权转移。 从技术角度来看,保管您所持有资产的数字钱包就是您的托管解决方案。可以说,在您将数字资产转让给交易所或资产管理人的情况下,拥有钱包的人就应负责钱包的管理工作。

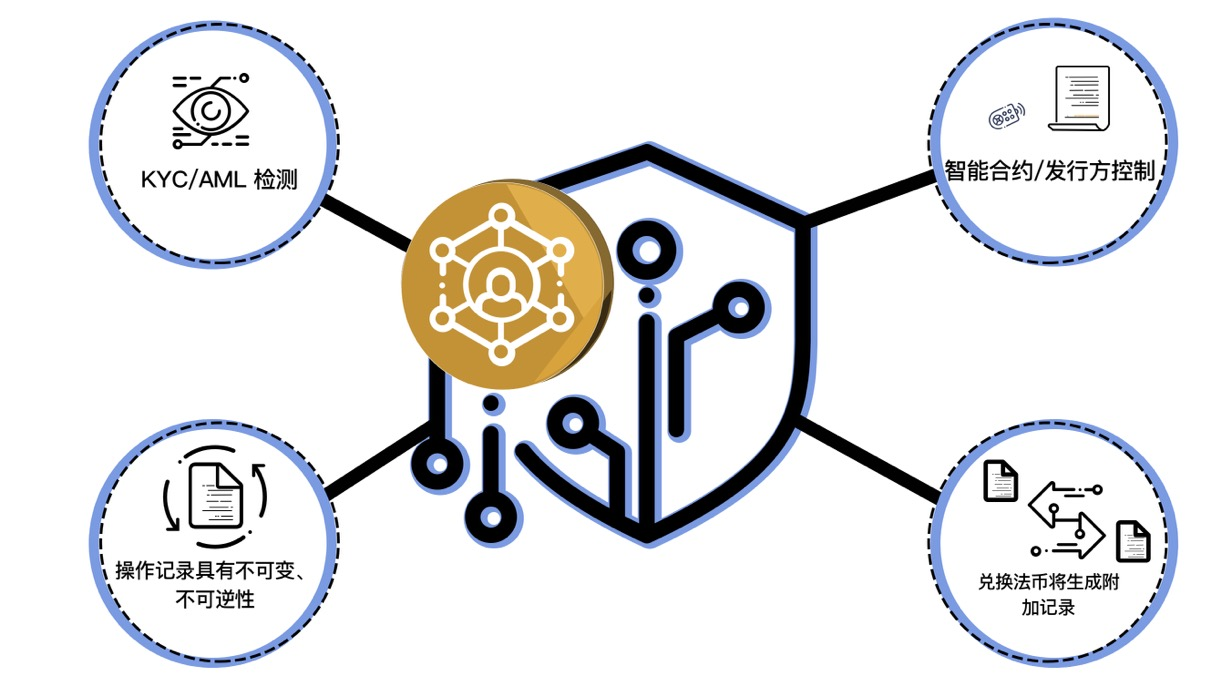

答案是否定的。就设计特点而言,数字资产在具有可追踪性的同时还拥有许多控制功能,从而有助于发行方防止欺诈和盗取行为的发生。与加密货币不同,数字资产本身就受相关部门的监管。为遵守“了解你的客户”(KYC)和反洗钱(AML)法规,在使用钱包前均需进行身份核查操作。如果有人转让了您的资产,甚至试图在交易所中进行出售,那么参与方、时间、地点和操作等相关记录均不可被篡改。

For larger asset-holders, transparency of information isn’t enough to feel totally secure. Hackers are smart and for many, they’d like more protection from potential threats. After all, you could have stolen access to a real person’s wallet to fake transactions through and cash out via a stablecoin. Still then, that stablecoin would require a currency conversion to FIAT and there would be an additional record with whichever institution performed the transaction. Finally, Security Tokens can be frozen, made moot, burned, and even reversed thanks to smart contracts and issuer controls. Thanks to these additional security controls, there are a number of measures available to ensure a secure environment in the cases of wallet theft.

对于大规模资产持有者来说,仅有信息的透明度不足以让他们完全放心。大多数资产方都希望得到更多的保护从而免受潜在的黑客威胁。毕竟,他们可以盗取资产所有人的钱包并利用稳定币进行虚假交易来进行套现。不过,套现操作意味着稳定币需要被兑换成法币。得益于智能合同的采用和发行方的控制,无论在哪家机构进行了交易,均会生成准确记录。最终,被盗取的数字资产可以被冻结、闲置、销毁,甚至反转。这些额外的安全控制措施可以在钱包被盗窃时确保数字资产的安全性。

This new digital environment is far more efficient, safer, and transparent than the traditional analog methods used today. Furthermore, the benefits of Security Tokens like liquidity, improved asset management, and governance efficiencies far outweigh the new cybersecurity element to custodianship.

这种新型数字环境相较于目前使用的传统模拟方法而言更加有效、更加安全也更加透明。此外,数字资产所拥有的诸多优点(如提升流动性、改善资产管理和提高治理效率等)也远超网络托管所带来的优势。

托管服务供应商的新角色

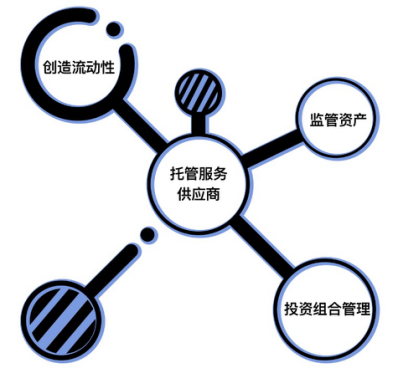

Beyond technology companies providing wallets that support Security Tokens like Knox Wallet by TokenSoft or Coinbase Custody supporting BCAP tokens, the value of custodians will become meaningful through the value-added services they can provide.

除了诸如TokenSoft的Knox Wallet和可支持BCAP托管服务的Coinbase等提供支持数字资产钱包服务的科技公司外,托管方的价值还通过提供增值服务而得以升华。

Exchanges may prefer that you custody tokens with them in order to make it easier for you to sell quickly. Brokers may want to do the same in order to find you buyers for your portfolio. Asset managers may streamline harvesting a large and diverse portfolio of security tokens for a fee.

交易所可能更倾向于与您一同进行资产托管以促成项目的快速售出。券商经纪人也青睐于共同托管资产以帮您的投资组合寻找到合适的买家。资产管理公司则可能通过收取费用来获得大量多元化的数字资产投资组合。

Creating Liquidity 创造流动性

Are you constantly checking all global markets (we count over 45 STO exchanges)? Do you have a vast network of institutional buyers and investors looking to name their own price over-the-counter? The business of finding buyers is a professional service provided by regulated firms whose very business is to create liquidity for you. In order to take advantage of these services, you will probably need to relinquish custody of your tokens.

您会时常关注全球市场动态吗(我们为您提供45家STO交易所的实时交易信息)?您是否拥有庞大的机构买家及投资者网络,并希望在场外自行定价?合规公司为您提供寻找买方的专业服务并致力于为您的资产创造流动性。但在享有上述服务的同时,您可能会被要求放弃对所持有资产的托管权益。

Administrating Assets 监管资产

Not all Security Tokens are created equally. You may have a portfolio of various real estate investments with some tokens still paying coupons/ distributions via a wire while other tokens pay using a stablecoin, and even still, other tokens that pay using some other way such as giving you more of the security token or paying with a cryptocurrency. Things get even more complicated when you expand that portfolio to debt products, fund vehicles, stablecoins, and other Security Tokens all of which need to be managed and harvested. Professional asset managers will come in and help you do this but will again require that you custody the tokens with them.

数字证券各不相同。投资者可能会持有多元化的房地产投资组合,其中一些证券仍通过电讯的方式派发优惠券/股息,也有一些证券派发稳定币,更有甚者采用给与投资者更多数字证券或直接使用加密货币进行支付。当投资组合还涉及到其他需要打理的债务产品、基金工具、固定资产和其他证券代币时,其监管的难度会进一步提升。专业资产经理将提供此类服务,但其往往会索求此类资产的托管权。

Active Portfolio Management 投资组合管理

Security Tokens enable a whole new set of applications for assets. Private markets can become more efficient, transparent, and liquid and as a result, there will be more price movement and potential to create alpha. Fund managers will seek to stake or custody your portfolio of tokens knowing that they can create real returns on managing that portfolio on your behalf.

数字证券开创了资产应用的新纪元,它的出现可以提升私人市场的有效性和透明度,并能增强市场的流动性更强,从而提供出更多的价格变动可能与收益。鉴于基金经理可以在代表客户管理投资组合的过程中创造真实收益,因此他们将寻求入股或为客户的数字证券投资组合提供托管服务。

The future of private securities is getting an upgrade and traditional custodian issues are largely removed through technology and new processes that will eventually become best practices for the industry to adopt. How Security Tokens get leveraged and managed in the future will vary depending on the type of investor but ultimately the investing experience will be digital, and as a result, will be more easily accessible, will have more capabilities, and will be more investor-friendly.

随着私人证券的不断发展,传统托管服务中的大部分痛点也将随着技术与新兴解决方案的采用而得以解决。这些技术与方案也终将成为行业采用的最佳实践。虽然未来数字证券的采用和管理方式将取决于投资方的具体类别,但毋庸置疑的是投资操作将更加数字化,最终实现准入要求的简化、增加功能并打造出对投资方更为友好的环境。

** This is a report from RedBlock’s partner, STA (Security Token Advisors),and is translated by RedBlock. Please indicate the original source when citing!

** 转自RedBlock合作方STA研究报告,由RedBlock编译,转载请标明出处!

如今,数字化资产的托管与投资方式已经发生了翻天覆地的变化。

An Improved Investment Experienc投资体验得以改善

For the first time ever, investing in private securities can be a completely digital experience with Security Tokens. Previously, if you were making an investment in a private company then chances were highly likely that your ownership interest was represented by a few legal documents and a capitalization table that was managed by the company.随着数字证券的诞生,投资私人证券拥有了完全数字化的新体验。以前投资私人公司时,您的所有者权益很有可能仅会体现在法律文书和由该公司管理的资本化表单之中。

Attempting to sell or transfer your ownership would be a governance procedure that involved lawyers and management. The analog task typically costs time and money. Tools like Carta can help address this pain point, but the available options do not offer a comprehensive solution for the entire process, especially outside of the venture asset class. Secondary markets for any of these asset classes have been exceptionally rare, so the need for custodians was never apparent. Now that we are developing new and innovative solutions for asset-holders in these industries, it is clear that a more complete solution is needed.

试图出售或转让您的所有权将是事涉律师和管理层的受监管过程。模拟任务通常需要耗费时间和金钱。而像Carta一类的工具就可以帮助解决这一痛点,但其可用功能却并不能为整个过程提供全方位的解决方案(尤其是非风险资产类别的操作)。这些资产类别的二级市场极为罕见,因此对托管人的需求从未明确。既然我们正在致力于为这些行业的资产持有人开发新的创新解决方案,那么显然就需要设计出一个更加完整的解决方案。

Now enter the era of security tokens, where investors receive a legally-binding, digital representation of the ownership in the asset they just purchased. The technology enables easy transfer of ownership with minimal impact on the management as records are automatically updated by smart contracts. From a technical perspective, the digital wallet that holds your Security Tokens is your custody solution. An argument could even be made that whoever owns the wallet is responsible for its custody in cases where you transfer your Security Tokens to an exchange or asset manager.

在数字资产新纪元中,投资者在购进资产后即刻便可获得具有法律约束力的数字化资产所有权证。由于智能合约会自动更新记录,因此该技术可以在将对管理的影响最小化的前提下轻松地实现所有权转移。 从技术角度来看,保管您所持有资产的数字钱包就是您的托管解决方案。可以说,在您将数字资产转让给交易所或资产管理人的情况下,拥有钱包的人就应负责钱包的管理工作。

Can My Security Tokens Be Stolen? 我的数字资产会被盗取吗?

The short answer is no. By design, Security Tokens are traceable and feature a number of controls to enable issuers to prevent fraud and stealing. Unlike with cryptocurrencies, Security Tokens are part of a regulated ecosystem. Participating in that ecosystem requires your wallet to have performed identity checks on you for the purpose of complying with Know-Your-Customer (KYC) and Anti-Money Laundering (AML) regulations. If someone transferred your tokens and even attempted to sell them on an exchange, the record of who, when, where, and what is constant and infallible.答案是否定的。就设计特点而言,数字资产在具有可追踪性的同时还拥有许多控制功能,从而有助于发行方防止欺诈和盗取行为的发生。与加密货币不同,数字资产本身就受相关部门的监管。为遵守“了解你的客户”(KYC)和反洗钱(AML)法规,在使用钱包前均需进行身份核查操作。如果有人转让了您的资产,甚至试图在交易所中进行出售,那么参与方、时间、地点和操作等相关记录均不可被篡改。

For larger asset-holders, transparency of information isn’t enough to feel totally secure. Hackers are smart and for many, they’d like more protection from potential threats. After all, you could have stolen access to a real person’s wallet to fake transactions through and cash out via a stablecoin. Still then, that stablecoin would require a currency conversion to FIAT and there would be an additional record with whichever institution performed the transaction. Finally, Security Tokens can be frozen, made moot, burned, and even reversed thanks to smart contracts and issuer controls. Thanks to these additional security controls, there are a number of measures available to ensure a secure environment in the cases of wallet theft.

对于大规模资产持有者来说,仅有信息的透明度不足以让他们完全放心。大多数资产方都希望得到更多的保护从而免受潜在的黑客威胁。毕竟,他们可以盗取资产所有人的钱包并利用稳定币进行虚假交易来进行套现。不过,套现操作意味着稳定币需要被兑换成法币。得益于智能合同的采用和发行方的控制,无论在哪家机构进行了交易,均会生成准确记录。最终,被盗取的数字资产可以被冻结、闲置、销毁,甚至反转。这些额外的安全控制措施可以在钱包被盗窃时确保数字资产的安全性。

This new digital environment is far more efficient, safer, and transparent than the traditional analog methods used today. Furthermore, the benefits of Security Tokens like liquidity, improved asset management, and governance efficiencies far outweigh the new cybersecurity element to custodianship.

这种新型数字环境相较于目前使用的传统模拟方法而言更加有效、更加安全也更加透明。此外,数字资产所拥有的诸多优点(如提升流动性、改善资产管理和提高治理效率等)也远超网络托管所带来的优势。

The New Role

of

Custody Providers

托管服务供应商的新角色

Beyond technology companies providing wallets that support Security Tokens like Knox Wallet by TokenSoft or Coinbase Custody supporting BCAP tokens, the value of custodians will become meaningful through the value-added services they can provide.

除了诸如TokenSoft的Knox Wallet和可支持BCAP托管服务的Coinbase等提供支持数字资产钱包服务的科技公司外,托管方的价值还通过提供增值服务而得以升华。

Exchanges may prefer that you custody tokens with them in order to make it easier for you to sell quickly. Brokers may want to do the same in order to find you buyers for your portfolio. Asset managers may streamline harvesting a large and diverse portfolio of security tokens for a fee.

交易所可能更倾向于与您一同进行资产托管以促成项目的快速售出。券商经纪人也青睐于共同托管资产以帮您的投资组合寻找到合适的买家。资产管理公司则可能通过收取费用来获得大量多元化的数字资产投资组合。

Creating Liquidity 创造流动性

Are you constantly checking all global markets (we count over 45 STO exchanges)? Do you have a vast network of institutional buyers and investors looking to name their own price over-the-counter? The business of finding buyers is a professional service provided by regulated firms whose very business is to create liquidity for you. In order to take advantage of these services, you will probably need to relinquish custody of your tokens.

您会时常关注全球市场动态吗(我们为您提供45家STO交易所的实时交易信息)?您是否拥有庞大的机构买家及投资者网络,并希望在场外自行定价?合规公司为您提供寻找买方的专业服务并致力于为您的资产创造流动性。但在享有上述服务的同时,您可能会被要求放弃对所持有资产的托管权益。

Administrating Assets 监管资产

Not all Security Tokens are created equally. You may have a portfolio of various real estate investments with some tokens still paying coupons/ distributions via a wire while other tokens pay using a stablecoin, and even still, other tokens that pay using some other way such as giving you more of the security token or paying with a cryptocurrency. Things get even more complicated when you expand that portfolio to debt products, fund vehicles, stablecoins, and other Security Tokens all of which need to be managed and harvested. Professional asset managers will come in and help you do this but will again require that you custody the tokens with them.

数字证券各不相同。投资者可能会持有多元化的房地产投资组合,其中一些证券仍通过电讯的方式派发优惠券/股息,也有一些证券派发稳定币,更有甚者采用给与投资者更多数字证券或直接使用加密货币进行支付。当投资组合还涉及到其他需要打理的债务产品、基金工具、固定资产和其他证券代币时,其监管的难度会进一步提升。专业资产经理将提供此类服务,但其往往会索求此类资产的托管权。

Active Portfolio Management 投资组合管理

Security Tokens enable a whole new set of applications for assets. Private markets can become more efficient, transparent, and liquid and as a result, there will be more price movement and potential to create alpha. Fund managers will seek to stake or custody your portfolio of tokens knowing that they can create real returns on managing that portfolio on your behalf.

数字证券开创了资产应用的新纪元,它的出现可以提升私人市场的有效性和透明度,并能增强市场的流动性更强,从而提供出更多的价格变动可能与收益。鉴于基金经理可以在代表客户管理投资组合的过程中创造真实收益,因此他们将寻求入股或为客户的数字证券投资组合提供托管服务。

The future of private securities is getting an upgrade and traditional custodian issues are largely removed through technology and new processes that will eventually become best practices for the industry to adopt. How Security Tokens get leveraged and managed in the future will vary depending on the type of investor but ultimately the investing experience will be digital, and as a result, will be more easily accessible, will have more capabilities, and will be more investor-friendly.

随着私人证券的不断发展,传统托管服务中的大部分痛点也将随着技术与新兴解决方案的采用而得以解决。这些技术与方案也终将成为行业采用的最佳实践。虽然未来数字证券的采用和管理方式将取决于投资方的具体类别,但毋庸置疑的是投资操作将更加数字化,最终实现准入要求的简化、增加功能并打造出对投资方更为友好的环境。

** This is a report from RedBlock’s partner, STA (Security Token Advisors),and is translated by RedBlock. Please indicate the original source when citing!

** 转自RedBlock合作方STA研究报告,由RedBlock编译,转载请标明出处!

- 免责声明

- 世链财经作为开放的信息发布平台,所有资讯仅代表作者个人观点,与世链财经无关。如文章、图片、音频或视频出现侵权、违规及其他不当言论,请提供相关材料,发送到:2785592653@qq.com。

- 风险提示:本站所提供的资讯不代表任何投资暗示。投资有风险,入市须谨慎。

- 世链粉丝群:提供最新热点新闻,空投糖果、红包等福利,微信:juu3644。

通讯周刊

通讯周刊